Wholesale And Distribution Automotive Aftermarket Market In 2029

The Business Research Company's Wholesale and Distribution Automotive Aftermarket Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

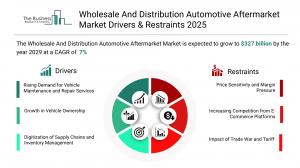

LONDON, GREATER LONDON, UNITED KINGDOM, January 9, 2026 /EINPresswire.com/ -- Wholesale And Distribution Automotive Aftermarket Market to Surpass $327 billion in 2029. In comparison, the Motor Vehicle And Motor Vehicle Parts And Supplies Wholesalers market, which is considered as its parent market, is expected to be approximately $9,927 billion by 2029, with Wholesale And Distribution Automotive Aftermarket to represent around 3% of the parent market. Within the broader Retail And Wholesale industry, which is expected to be $118,687 billion by 2029, the Wholesale And Distribution Automotive Aftermarket market is estimated to account for nearly 0.3% of the total market value.

Which Will Be the Biggest Region in the Wholesale And Distribution Automotive Aftermarket Market in 2029

North America will be the largest region in the wholesale and distribution automotive aftermarket market in 2029, valued at $104,071 million. The market is expected to grow from $79,410 million in 2024 at a compound annual growth rate (CAGR) of 6%. The strong growth is supported by the digitization of supply chains and inventory management and expanded manufacturing facility.

Which Will Be The Largest Country In The Global Wholesale And Distribution Automotive Aftermarket Market In 2029?

The USA will be the largest country in the wholesale and distribution automotive aftermarket market in 2029, valued at $88,395 million. The market is expected to grow from $67,020 million in 2024 at a compound annual growth rate (CAGR) of 6%. The strong growth can be attributed to the digitization of supply chains and inventory management and product launched.

Request a free sample of the Wholesale And Distribution Automotive Aftermarket Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=7218&type=smp

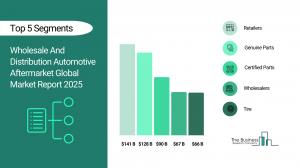

What will be Largest Segment in the Wholesale And Distribution Automotive Aftermarket Market in 2029?

The wholesale and distribution automotive aftermarket market growth is segmented by replacement part into tire, battery, brake parts, filters, body parts, lighting and electronic components, wheels, exhaust components and other replacement parts. The tire market will be the largest segment of the wholesale and distribution automotive aftermarket market segmented by replacement part, accounting for 27% or $87,439 million of the total in 2029. The tire market will be supported by growing vehicle parc and replacement cycles that drive repeat purchases, strong demand from commercial fleets and ride-hailing services requiring frequent replacements, seasonal and performance tire needs (winter/sport/all-terrain) that expand SKU (Stock keeping unit_ variety, modernization of retail and e-commerce channels that improve availability and delivery speed, tire retreading and recycling value chains that extend aftermarket demand and tire safety and regulatory testing standards that favor certified aftermarket suppliers.

The wholesale and distribution automotive aftermarket market is segmented by certification into genuine parts, certified parts and uncertified parts. The genuine parts market will be the largest segment of the wholesale and distribution automotive aftermarket market segmented by certification, accounting for 50% or $162,623 million of the total in 2029. The genuine parts market will be supported by OEM (original equipment manufacturers) backing and brand trust that command premium pricing, warranty compliance rules that require or incentivize genuine replacements, integrated OEM distribution networks that guarantee fit and traceability, higher perceived quality and reliability that appeal to risk-averse buyers and fleets and manufacturer training/support programs for installers that reinforce dealer channel sales.

The wholesale and distribution automotive aftermarket market is segmented by distribution channel into retailers, wholesalers and distributors. The retailers market will be the largest segment of the wholesale and distribution automotive aftermarket market segmented by distribution channel, accounting for 58% or $188,912 million of the total in 2029. The retailers market will be supported by consumer footfall and immediate access to retail points for urgent parts, value-added in-store services (fitting, advice, diagnostics) that drive sales, storefront brand presence and promotions that influence buyer choice, omnichannel integration (click-and-collect, online catalogues) that expands reach and partnership programs with local garages that increase cross-sell opportunities. Retailers are the largest and fastest-growing channel. This reflects the strength of large chains (e.g., AutoZone, Advance Auto Parts) and the growing online B2C channel.

What is the expected CAGR for the Wholesale And Distribution Automotive Aftermarket Market leading up to 2029?

The expected CAGR for the wholesale and distribution automotive aftermarket market leading up to 2029 is 7%.

What Will Be The Growth Driving Factors In The Global Wholesale And Distribution Automotive Aftermarket Market In The Forecast Period?

The rapid growth of the global wholesale and distribution automotive aftermarket market leading up to 2029 will be driven by the following key factors that are expected to reshape automotive supply chains, retail strategies, and service operations worldwide.

Rising Demand For Vehicle Maintenance And Repair Services - The rising demand for vehicle maintenance and repair services will become a key driver of growth in the wholesale and distribution automotive aftermarket market by 2029. As consumers keep and use vehicles longer and as advanced systems (safety, electronics) require periodic calibration and servicing, demand for maintenance and repair rises. This means repair shops and service chains will depend more on fast, reliable access to quality aftermarket parts, placing a premium on distributors who can deliver breadth, speed and service. Wholesale distributors may also offer value-added services (kitting, diagnostic modules and calibration parts) to repair centers. Thus, the aftermarket wholesale and distribution channel will need to evolve from mere parts delivery to an integrated service enabler, linking parts, data, diagnostics and supply agility. As a result, the rising demand for vehicle maintenance and repair services is anticipated to contributing to a 2.0% annual growth in the market.

Growth In Vehicle Ownership - The growth in vehicle ownership will emerge as a major factor driving the expansion of the wholesale and distribution automotive aftermarket market by 2029. As more vehicles come on the road, the base of vehicles that require maintenance, part replacement and repair naturally expands. This enlarges the addressable market for aftermarket parts, giving wholesalers and distributors more volume to serve. Also, with vehicle fleets aging, the aftermarket opportunity intensifies (older vehicles require more parts). Wholesalers will increasingly supply across a wider and deeper part catalog; distribution footprints and logistics reach to serve the growing installed base. Consequently, the growth in vehicle ownership is projected to contributing to a 1.5% annual growth in the market.

Digitization Of Supply Chains And Inventory Management - The digitization of supply chains and inventory management will serve as a key growth catalyst for the wholesale and distribution automotive aftermarket market by 2029. Digitization yields greater visibility, agility and predictive control in supply chains. In the aftermarket wholesale and distribution context, real-time inventory tracking, demand forecasting, automated replenishment and supplier integration will reduce stockouts, overstocking and obsolescence. Distributors will evolve into digital platforms or “data hubs” that coordinate demand data, parts flows, logistics and supplier networks across regions. This will enable more efficient distribution, shorter lead times, lower holding costs and ultimately stronger competitiveness. Distributors who adopt digital supply chains will better respond to shocks (chip shortages, trade issues) and capture evolving demand patterns. Therefore, this digitization of supply chains and inventory management is projected to supporting to a 1.0% annual growth in the market.

Government Regulations Promoting Vehicle Safety - The government regulations promoting vehicle safety will become a significant driver contributing to the growth of the wholesale and distribution automotive aftermarket market by 2029. Strict safety regulations compel parts suppliers, distributors and aftermarket players to ensure that components meet prescribed safety and performance standards (for example, lighting, brake hoses, mirrors and crashworthiness). As regulations grow stricter (e.g., overseeing automated driving features and stronger safety audits), aftermarket distributors will have more responsibility (and liability) to vet, certify and trace parts. Thus, companies in wholesale and distribution will need stronger quality assurance, traceability systems, supplier compliance audits and perhaps secure supply chains to ensure that replacement parts do not void safety requirements or expose them to recalls. This will raise barriers for low-quality players and favor distributors who build certification, traceability and compliance into their systems. Consequently, the government regulations promoting vehicle safety is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Wholesale And Distribution Automotive Aftermarket Market report here:

https://www.thebusinessresearchcompany.com/report/wholesale-and-distribution-automotive-aftermarket-global-market-report

What Are The Key Growth Opportunities In The Wholesale And Distribution Automotive Aftermarket Market in 2029?

The most significant growth opportunities are anticipated in the wholesale and distribution automotive aftermarket for tire distribution market, the wholesale and distribution automotive aftermarket certified parts market, and the automotive aftermarket wholesale, distribution, and retail market. Collectively, these segments are projected to contribute over $125 billion in market value by 2029, driven by the adoption of digital sales platforms, advanced inventory and supply chain management systems, and the increasing demand for electric vehicle components and performance parts. This surge reflects the accelerating integration of technology and data-driven logistics that enable faster, more efficient distribution, enhanced service quality, and optimized inventory management, fueling transformative growth within the broader automotive aftermarket industry.

The automotive aftermarket wholesale, distribution, and retail market by $57,628 million, the wholesale and distribution automotive aftermarket certified parts market by $42,261 million, and the wholesale and distribution automotive aftermarket for tire distribution market is projected to grow by $25,228 million over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.